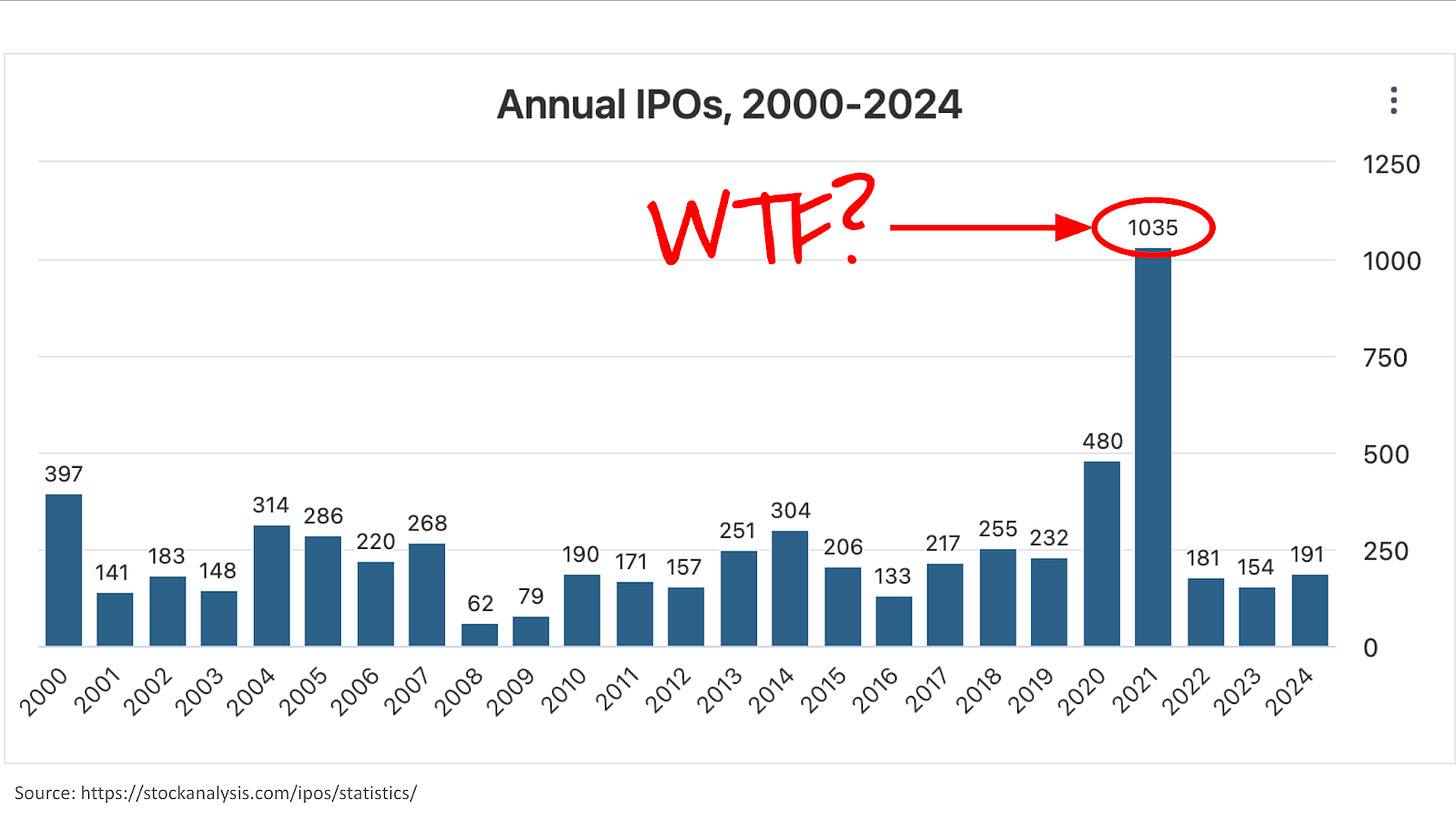

In 2021, Wall Street had a fever, and the only prescription was more IPOs. Several factors drove the binge: surplus liquidity, low interest rates, and an explosion of special purpose acquisition companies (SPACs). That’s a nice way to say there was a lot of money sloshing around, Wall Street had a shiny new vehicle, and COVID-19 made everyone stupid.

IPOs are the choice of low-IQ investors. This is not news. Academic studies consistently show that IPOs as a class underperform the market. Rare cases like Google are exceptions to the general rule that IPOs suck.

Take the C3.ai IPO, for example. C3 opened at $120 on December 11, 2020, climbed briefly to $160 just before Christmas, and held on until February. When the 90-day trading lockouts expired, employees dumped the stock like tea in Boston Harbor. C3 plunged, closing at $31 at the end of 2021.

Anyone who read the S-1 could see that C3 was a garbage company, but COVID-19 impaired reading comprehension.

If IPOs are a bad investment, SPACs are even worse. Investment bankers use SPACs to dodge the regulations governing IPOs. To nobody’s surprise, the companies that go public with a SPAC tend to be those that can’t stand up to the scrutiny of a regular IPO. Investment bankers pushed them hard in 2021, and SPAC volume exploded. It collapsed in 2022 when Wall Street ran out of suckers.

But I digress.

IPO volume drives late-stage investing volume. Late-stage investors want a predictable path to an exit by IPO or M&A (mergers and acquisitions.) They are picky about where they put their money; they want it back sooner, not later. VC money goes to late-stage startups on track to an IPO in a year or two.

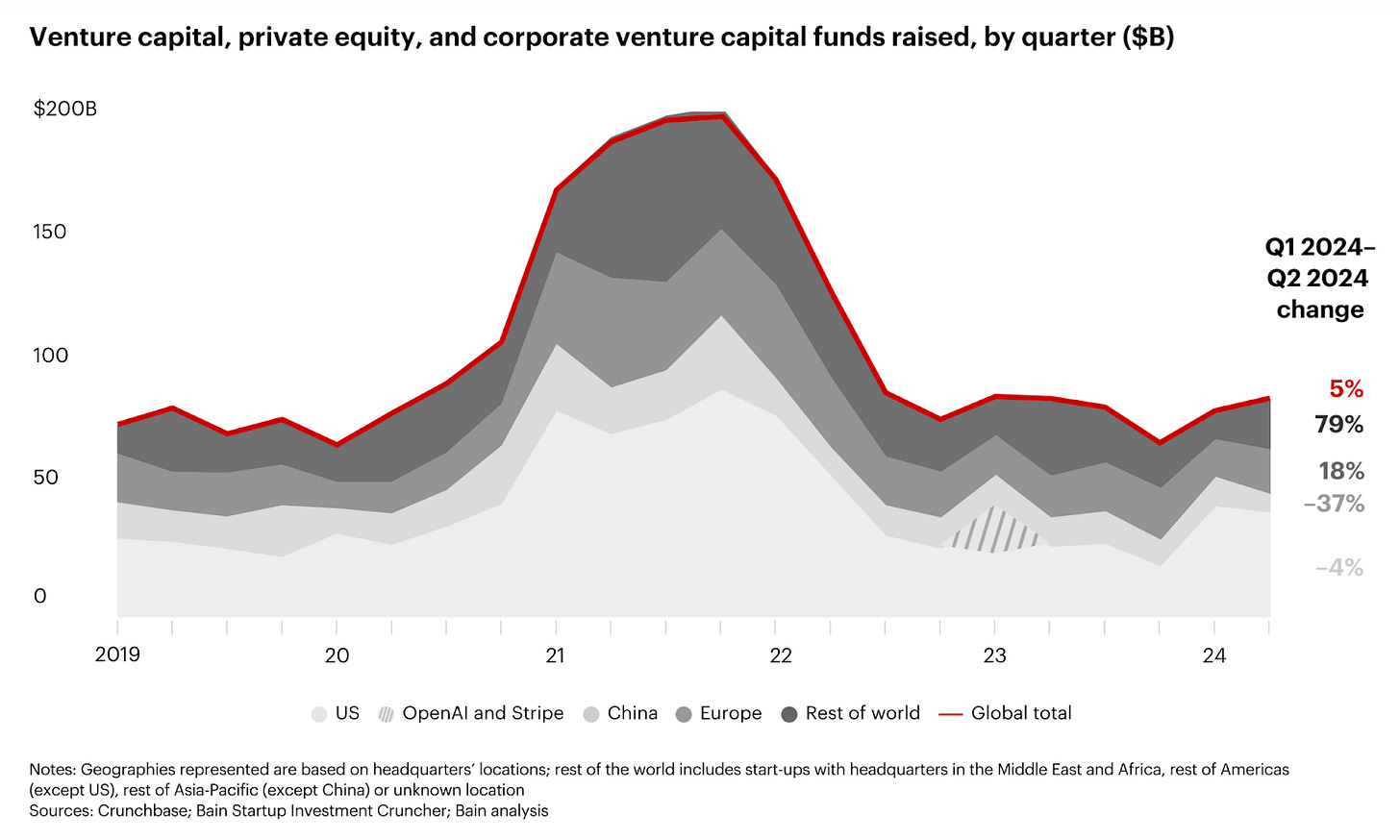

In 2021, with the demand for IPOs off the charts, VCs unleashed a tsunami of money:

The graph is misleading. Seed and early-stage venture funding remained relatively stable before, during, and after the bubble. Late-stage venture funding, on the other hand, exploded in 2021 and subsequently collapsed.

During the bubble, VCs practiced “greater fool” investing – they assumed they could sell their stakes to other investors who were even dumber than themselves. Here are a few examples:

June 2021: Tiger Global and Altimeter Capital led a Series G for DataRobot at a valuation of $6 billion, triple its valuation seven months earlier.

July 2021: Blackstone led a Series H for Gopuff at a valuation of $14 billion, double its valuation three months earlier.

December 2021: XN led a Series F for Airtable at a valuation of $5.5 billion, double its valuation nine months earlier.

On what planet do businesses double and triple their intrinsic value in a few months?

The problem with “greater fool” investing: eventually, you learn that you are the greatest fool.

Every tsunami recedes. The flood of venture money peaked in Q3 2021. In early 2022, VCs spread the word to startup execs: forget about new money, the well’s dry.

The well wasn’t completely dry; late-stage venture capital collapsed but did not disappear. High-quality companies could still raise money. A few examples:

Stripe secured $6.5 billion in a Series I (March, 2023)

Databricks raised $500 million in a Series I (September, 2023)

AlphaSense landed $650 million in a Series F (June 2024)

Anduril Industries scored $1.5 billion in a Series F (August 2024)

Unfortunately, many former unicorns are out in the cold. According to Crunchbase, 227 unicorns secured new funding during the VC boom but have raised no money since then.

Execs at these companies sometimes say they haven’t raised capital because “they don’t need it.” This is bullshit, of course. Like the coach of a losing football team who says they “don’t need to win.” Venture capital fuels growth. Any startup with a solid product and GTM approach can use more investor money. Startups that can’t burn cash will not grow as fast as startups with money to burn.

Growth is the only thing that matters to investors. Thus, startups cut off from regular infusions of investor cash risk a doom spiral through successive layoffs and retrenchment. If they cut costs aggressively, they can stabilize the company and sell out at a decent valuation. Otherwise, when the cash balance is gone, they will hold a fire sale – an emergency liquidation, with assets sold at a discount.

The transition is wrenching for any company. Unicorns on an IPO track hire like drunken sailors; employees get referral bonuses to bring in their friends, and hiring standards can be, well, loose. Compensation is generous; management hands out stock options like M&Ms. People work together chasing the Holy Grail of going public.

All that goes out the window when it’s time to cut the burn rate. Layoffs done in haste often throw out the baby with the bath water. The cadence of product improvement slows, and customers may sense a decline in support. It takes exceptional leadership to keep a stranded unicorn going until it can be sold.

Some of the stranded unicorns are dead unicorns. Argo AI, Katerra, and Olive AI discontinued operations and fired their people.

Argo AI: Remember self-driving cars? Argo AI built software, hardware, maps, and cloud-support infrastructure for self-driving vehicles. Founded by veterans of the autonomous vehicle programs at Google and Uber, Argo raised at least $3.6 billion from Ford, Lyft, and Volkswagen. The company said it could deliver Level 4 fully autonomous self-driving systems. In July 2021, when Lyft invested in the company, its agreed valuation was $12.4 billion.

Technically, Argo AI was not a venture-funded startup because “strategic” investors financed the company. I’m including it anyway because it is a glorious example of hype and failure.

July 2021 was peak AV. There were plenty of skeptics all along – including me – and it turns out that the skeptics were right. The owners pulled the plug when Argo lost $827 million in the third quarter of 2022. Ford and VW took multi-billion dollar accounting hits. The two companies salvaged some of the technology. They have abandoned the chase for fully autonomous vehicles and focus on human-in-the-loop AI.

Sometimes, failure is an option.

Katerra: Katerra “made buildings in a factory,” which sounds like trailer parks. Venture capitalists thought that concept seemed promising and invested $1.6 billion in twelve separate funding rounds. The largest round, a Series D in 2018, raised $865 million. SoftBank Vision Fund led the round.

Business results did not meet investor expectations. Softbank continued to sink money into this dog and replaced the founder. The company collapsed, laid off its people (with no earned personal time or severance), and walked away from active projects. The company blamed the COVID-19 pandemic as if we hadn’t heard that one before.

SoftBank is the Jim Cramer of venture capital.

Olive AI: I wrote about the life and death of Olive AI here, here, and here.

Olive AI could not escape the death spiral because it never had a real product. The RPA solution it hyped was vaporware; in reality, the company developed custom BPM solutions for every client. Those solutions required constant maintenance; when the company started cutting people, clients quickly felt the impact. Customer attrition accelerated in the summer of 2022, leading to more job cuts and doom.

Seventeen stranded unicorns were acquisition targets. Many of these transactions look like fire sales.

Zymergen: Zymergen raised $974 million in six rounds. In July 2022, Ginkgo Bioworks acquired the company for $300 million in stock. Since that transaction, Ginkgo’s stock price has declined 91%, making Zymergen’s former owners very sad.

Perch: Perch landed $909 million in four rounds. In March 2024, Berlin-based Razor Group acquired the company for an undisclosed price paid in Razor stock. Before the deal, Razor’s pre-money valuation was $1.2 billion. Afterward, Razor reported a valuation of $1.6 billion, which means the Perch shareholders lost their shirts.

Heyday: Heyday, founded in 2020, secured $800 million in three rounds. In September 2024, after steadily losing 40% of its workforce, the company sold itself to Branded, a New York-based company that immediately rebranded itself as Essor. Neither Essor nor Heyday disclosed the deal terms, which means they sucked. The combined entity continues to shed people.

That leaves 204 stranded unicorns. I can’t write a profile for all of them, so here is a selection of four.

Pacaso: With Pacaso, even you can live an elevated life. Picasso’s pitch is “luxury vacation co-ownership,” which sounds a lot like time-sharing. Twenty-eight investors sunk $1.5 billion into this venture in six funding rounds. Guess who led the Series C in 2021? If you guessed “SoftBank,” go to the head of the class.

Pacaso describes itself as a “community of high net-worth individuals,” but sadly, that community is shrinking. Revenue declined from $155 million in 2022 to $37 million in 2023. The company cut its losses by firing 35% of the workforce and scaling back marketing. Despite these moves, its cash-to-burn ratio was dangerously low at the end of last year.

One expense they did not cut was the private jet used for “business travel,” which the company conveniently leases from an entity owned and controlled by the Company’s co-founder and CEO. I’m sure they shopped carefully before signing that lease.

Venture capitalists won’t touch this company, but don't worry! Pacaso recently filed a Form 1-A declaring its intent to sell shares directly to the public through its website. The offering statement is interesting, especially the section that discloses related party transactions.

As a rule, I don’t offer free investment advice, but I’ll give you this one: don’t buy the shares.

Carta: Carta is a “global ownership management platform that helps companies, investors, and employees manage equity and ownership.” During the startup valuation bubble, tracking options was a good business. At least VCs thought so; 98 investors sunk $1.2 billion into this company in 13 rounds; its pre-money valuation hit $6.9 billion in August 2021.

Peter Walker, the Head of Insights at Carta, publishes posts about “VC Winter.” That’s his term for the current venture capital environment. It’s interesting stuff. Walker doesn’t mention that a bear market for VC is a bear market for Carta. When you sell a service to startups, growth is hard if your customers suffer an extinction event.

Carta did three rounds of layoffs in 2023. The third round came soon after stories hit the press about all sorts of bad behavior, including indecent exposure, groping, and a toxic culture. In other words, business as usual for Silicon Valley.

Some genius at Carta got a bright idea: let’s use customer data from the cap tables we manage to develop a brokerage business. It was a swell idea, real Einstein-level stuff. But oops! – they forgot to get permission from customers to use the data. Last January, a customer accused the company of approaching its investors about selling shares on the secondary market.

When the story broke, Carta dropped that hot potato.

So now, Carta is just a boring compliance service. Yawn. The company reported an ARR of $150 million in 2021; that’s not chump change, but without a growth story, the company isn’t worth $6.9 billion.

DataRobot: DataRobot, founded in 2012, delivered the first enterprise-grade automated machine-learning software. Fueled by seven rounds of venture capital, the company grew rapidly through 2019, when it hit some revenue headwinds.

Headcount peaked at around 2,000 in early 2020. Management’s response to the COVID-19 pandemic led to the first round of layoffs in April 2020. The company tossed its founders in March 2021 and announced a Series G round at a valuation of $6.3 billion.

That was a nonsense valuation, of course. The deal roughly coincided with secret stock sales by the CEO and CFO. I’m sure it’s purely coincidental that someone leaked information about the deal to Axios before the announcement.

The Series G round brought total investment in the company to $1.1 billion. New funding kept the lights on for less than a year, but the company missed sales targets. Layoffs ensued in the Spring of 2022.

In June 2022, The Information published a story about the executive stock sales. Shit hit the fan, and the CEO resigned. More layoffs followed. Six out of eleven members of the Board of Directors left, including all of the Audit Committee.

I’m not going to spell out why the Audit Committee quit. Think about what Audit Committees do, and you may figure it out.

A new management team took charge. They have worked diligently for the past two years to clean up the mess, resolve technical debt, and otherwise right the ship. DataRobot has strengthened its strategic partnerships and secured good reviews from key analysts. However, continued headcount reduction implies that the company has not yet found the right balance between revenue and costs.

Workrise: Workrise offers what it calls “The Source-to-Pay Solution Built for Energy.” Wow, that sounds like a hot technology play, maybe with artificial intelligence and stuff. Actually, it’s an employment agency or, as they say in the trade, a body shop. Founded in 2014 as RigUp, the company focused on oil and gas industry staffing.

Over several years, the company landed VC investments of over $750 million from 22 investors in 8 rounds. Expansion proved to be trickier than pitching ideas to investors. In early 2022, the company abandoned the industry expansion and sacked three-quarters of its workforce, according to TechCrunch.

Earlier this year, the company brought in two ex-Cloudera executives to serve as CEO and CMO; they lasted about two months and are now gone. Workrise’s “Leadership” page currently has no entries; it’s a new trend in management called the “leaderless turnaround.”

Stranded unicorns face difficult transitions, but they are not dead. Unicorns that reduce the burn rate to zero can survive indefinitely. That’s essential to negotiate a good price for an acquisition.

It’s like selling your house. If you lose your job and can’t pay the mortgage, you may have to take a lowball offer to avoid foreclosure. But if you still have income to cover the mortgage, you can hold out for the best price.

Lest all this talk about poor investments and failed unicorns make you sad, I will close this piece on a positive note.

Neo4J was on my list of stranded unicorns; the company last raised money in November 2021 at a valuation of $1.9 billion. But then, a few days ago, the company announced a fresh investment of $50 million at a valuation of $2.0 billion. That valuation is 10X ARR of $200 million at a 30% revenue growth rate. Neo4J says it’s “on track to be cash flow positive in the coming quarters,” which is good news if true.

So, a stranded unicorn can unstrand itself if it maintains sales growth. Grow or die.

All good points Thomas. The party's over once the VC money stops. Then it's matter of how bad the hangover is for you.

The VC business is funny business. Chamath Palihapitiy (promoter of SPACs) in a rare moment of truth explained how they work.

https://youtu.be/vv3Srp0QbmM?si=1VZoPmgyJ3_Ok8nT

During the hay days of funding, Datarobot acquired some companies which were not really a fit for it's product.

Paxata, Algorithmia, Zepl etc

Perhaps the VCs who made those valuations for Datarobot got rewarded with some exits??